This ongoing report on consumers provides valuable advertising and media news for marketers and advertisers. We curate stories of interest and insight. Use the button below to have each Audience Intel Report delivered directly to your inbox.

Get Intel Report EmailsMedia Roundup

Did advertisers get more for their money? Nielsen may have been undercounting viewers during the pandemic, according to an audit by the Media Rating Council (MRC). Numbers from the agency’s spot audit of February 2021 showed Nielsen’s figures adults 18-49 was understated by 2-6%. This could mean that advertisers have been getting more audience for their ad budget and TV platforms have been losing out on deserved revenue.

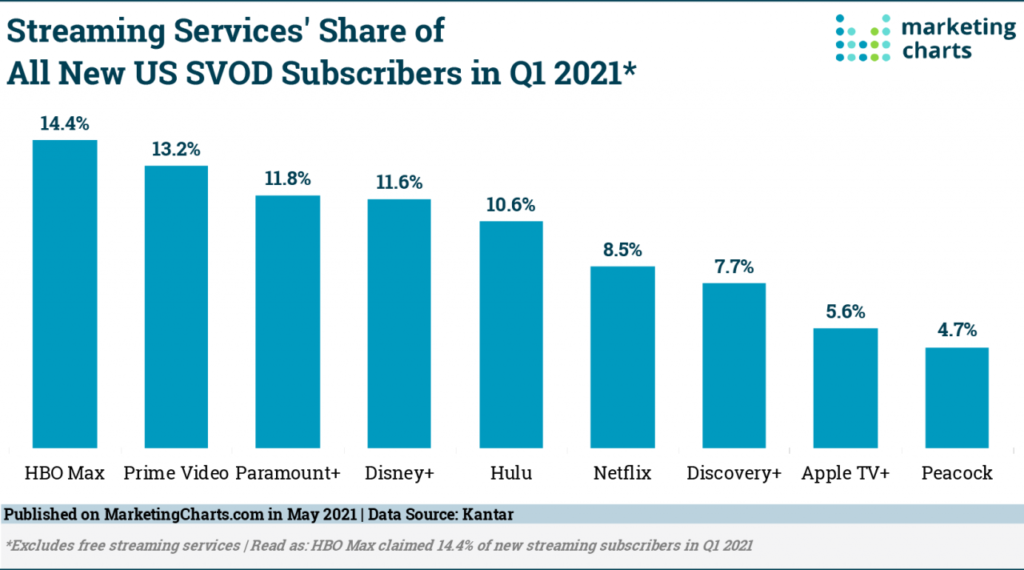

HBO Max maxes out in Q1. First-quarter data from Kantar research shows the premium streaming service from HBO leading the pack in sign-ups as 2021 began. More than 7% of US households subscribed to a new SVOD in Q1 2021, bringing their estimated number of SVOD subscriptions to 241 million. A separate report from Ampere Analysis estimated 340 million OTT contracts which would indicate more streaming video subscriptions than U.S. population.

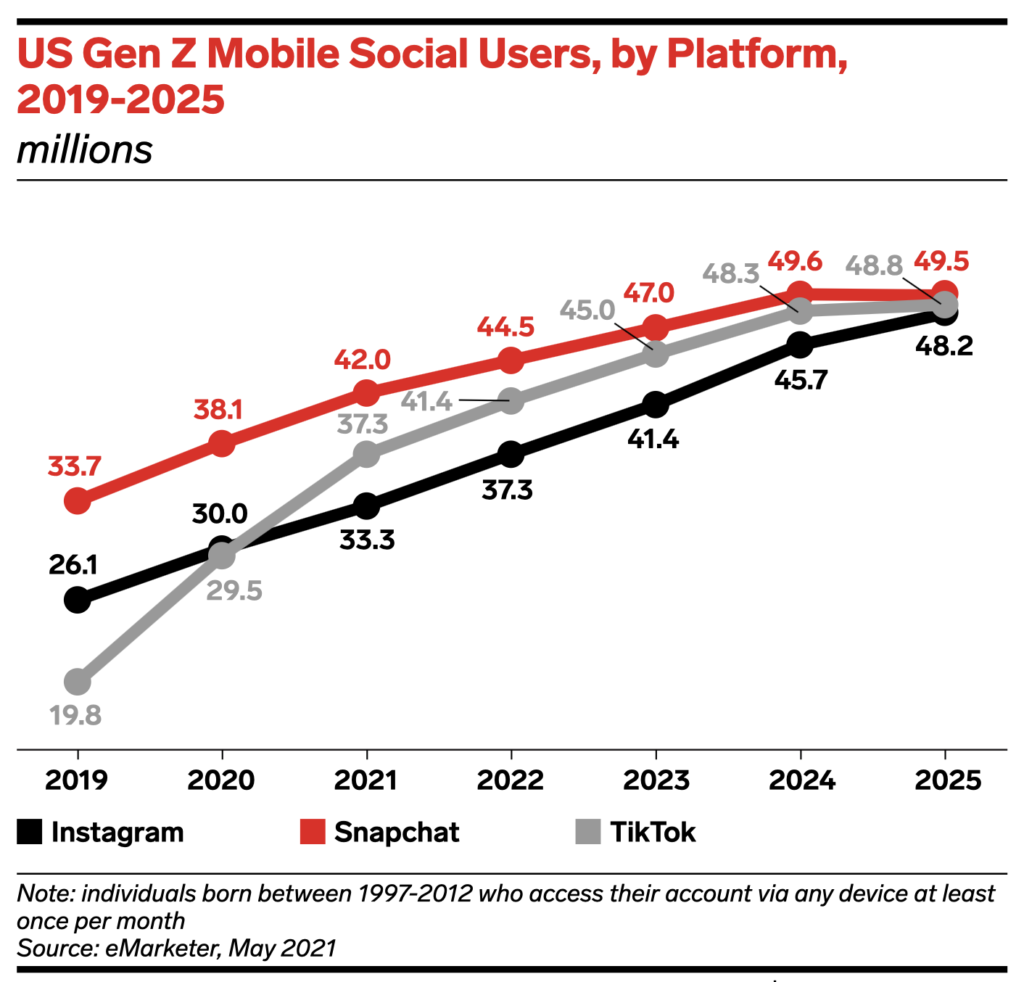

TikTok ascendant? By the end of this year, the video app is projected to have a larger number of Gen Z users in the US than that of Instagram according to an eMarketer analysis. According to the forecast, it could also surpass Snapchat in terms of total users by 2023.

Gambling on TV and Radio. Companies that provide sports gambling are spending big money on TV. Spend from the online gambling category was just $10.7 million in 2019 but has recently become a $154 million windfall for local TV according to Nielsen. Radio companies are taking notice with Bob Pittman, Chairman and CEO of iHeartMedia, last week called sports gambling “a great category for us,” noting the company has recently launched a pair of “Gambler”-branded radio stations.

Retail Roundup

Underwear in public. L Brands has decided to spin off Victoria’s Secret into its own publicly traded company rather than sell it. The holding company reportedly received several bids north of $3 billion but turned them down because it expects the company to be valued somewhere between $5 billion and $7 billion in a spinoff.

Putting a label on low prices. In an acknowledgement that it’s losing shoppers to low-price competition, Bed Bath and Beyond is rolling out a new value-based in-house brand to compete for bargain hunters who’ve been migrating to Amazon and Target.

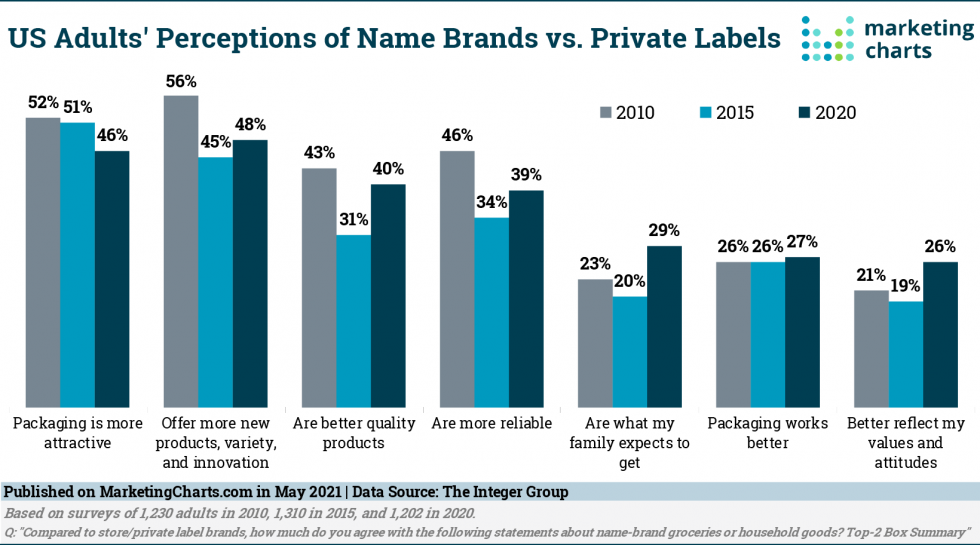

In a related story. Only 4 in 10 consumers believe that name brand products are better than private label. There are some indicators that the tide is turning back however as the number of respondents who say that name brand groceries or household goods are better quality products than private labels increased by nearly 10% over the past five years.

Get Intel Report Emails